THE TURNAROUND HAS NOW BEGUN!

In their last interim report, Concordia Maritime noted that their forecast of gradual improvement in the market is now beginning to materialise. CEO Kim Ullman says of the market:

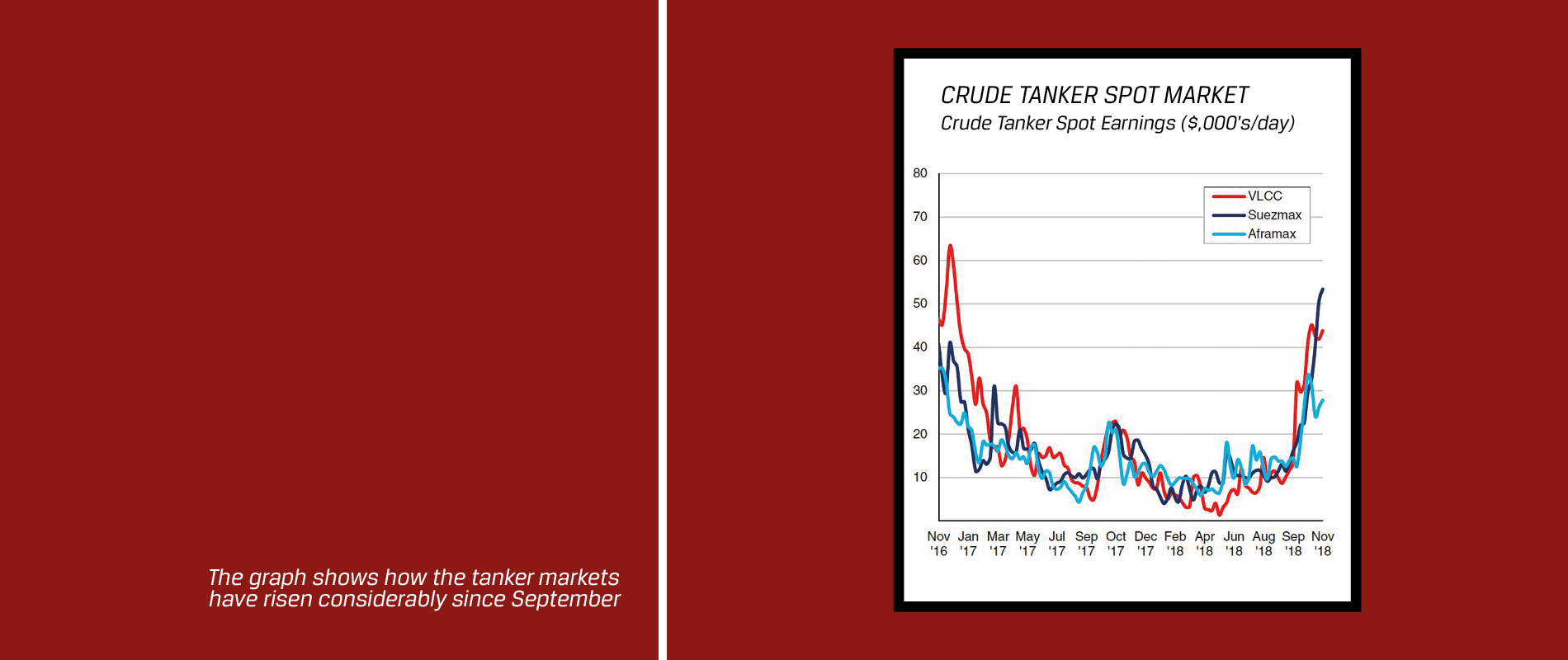

“The last few years have been tough for the entire tanker market. But after two years of a weak market, crude oil markets have risen considerably since September and even the product tanker markets began to improve in some parts of the world. Among the primary driving forces belong is OPEC, which has gradually been increasing production by between 500,000 and 1,000,000 barrels of oil per day since July. This is because inventory levels have fallen and with the increased production the need for transport has also increased.

More crude oil is thus in circulation, which has also boosted the product tanker market, because it is after all refined petroleum products that are used as an energy source in automobiles, aircraft and other applications.

Additionally, the market is moving steadily towards a better balance. Parallel with the increased need for transport, older vessels are being phased out, which is both due to high scrap prices but also to future legislative requirements. The new sulphur regulations coming into force in 2020 will contribute positively to the demand for tanker transportation, thanks to changes in transport flows and increased demand for new low-sulphur fuels.

It is very gratifying that our forecast of a turnaround has begun!”

ABOUT THE OIL PRICE

“We are often asked how oil prices affect the tanker market’s development – and the straight answer is that the development of oil prices in the short term has no direct impact. In the longer term, they benefit the tanker market, just as industry in general benefits from a low oil price.

At the time of writing, in mid-November, we have seen sharp declines in oil prices. From rising sharply in September and October, the price has now fallen as dramatically in recent weeks. Since the peak in early October, the drop has been about 25 per cent. This development gives a clear picture of how overreactions in trading and derivatives markets affect price developments. The increase was largely a result of the expected consequences related to sanctions against Iran, as well as disruptions in production in Libya and Venezuela. The sanctions against Iran ended up being not as extensive as many first thought, which, in combination with the US’s increased rate of production of shale oil and OPEC’s increased production, resulted in the price of oil falling.”