Dan Sten Olsson – May 2018

Nothing is calm but the sailing is good

At last the Oil Price enables the oil companies to make money on new projects leading to employment of our floating drilling units.

Starting in March at $64/bbl (barrel), the price of Brent (a North Sea Oil quality) has steadily rallied in the intervening period to reach $77/bbl as of 9th May. Strong compliance from OPEC was underpinned by Venezuela’s economic collapse which has decimated production in the country. Additional political risks, including the potential for the Syrian conflict to widen and the American abandonment of the nuclear deal with Iran, have added temporary premiums along the way.

Rising prices have seen many oil analysts to adjust their Brent price forecast for 2018 slightly higher to average $68/bbl in 2018, against $43.55/bbl in 2016 and $54.25/bbl in 2017. This represents a 56% total increase from to 2018. This forecast factors in any potential sell-off later in the year, e.g. when US shale oil production growth gets into its stride in the summer. Under a high price scenario, Brent can exceed an average of $70/bbl this year.

Continued growth in prices will slowly tighten the market for floating drilling units, supported by harsh environment and deep-water licensing rounds in the UK, Norway, USA, Brazil and Mexico. This is in addition to the continued scrapping (attrition) of units. Brazil and the USA have shown to have most demand in the near future, while in Australia and Southeast Asia, demand and marketed utilization are already recovering and will tighten further over the next two years.

Many forecast 1.7 million b/d (barrels per day) of oil demand growth both in 2018 and 2019 paired with corresponding strong IMF (International Monetary Fund) forecasts for GDP growth for both OECD and non-OECD states. Global demand growth stood at 1.55 million b/d in 2017. Also demand for LNG shipments are high with new capacity coming into production.

This enhanced demand is good for our oil tanker as well as our LNG tanker operation, which suffers losses at the moment.

As yearly production from existing conventional oil-fields without any new drilling is decreasing with three to four million barrels per day the demand for increased drilling is setting in with substantially higher demand already from this autumn. Thanks to present contracts and ongoing negotiations we expect all our drilling units to be employed from October this year.

Integrated oil majors now have free cash flow levels at an all-time high. With new cost restriction measures the Oil & Gas Industry has successfully managed to streamline their cost base and optimize their operation resulting in higher free cash flows. Total and Exxon has posted net adjusted profit of $2.9 billion and $4.65 billion for Q1 2018.

As reserve replacement ratio remains at a decade low and is in direct correlation with oil price upward trend, offshore field investment is up 40% y-o-y in 2017 to $80bn and expected to exceed $100bn in 2018 for the first time in five years. The Top 40 offshore players account for 80% of offshore investments and current outlook indicate that these players will invest around 115 billion per year until 2020. The current market projections indicate capex budgets increasing year-o-year with around 15%-20% until 2020.

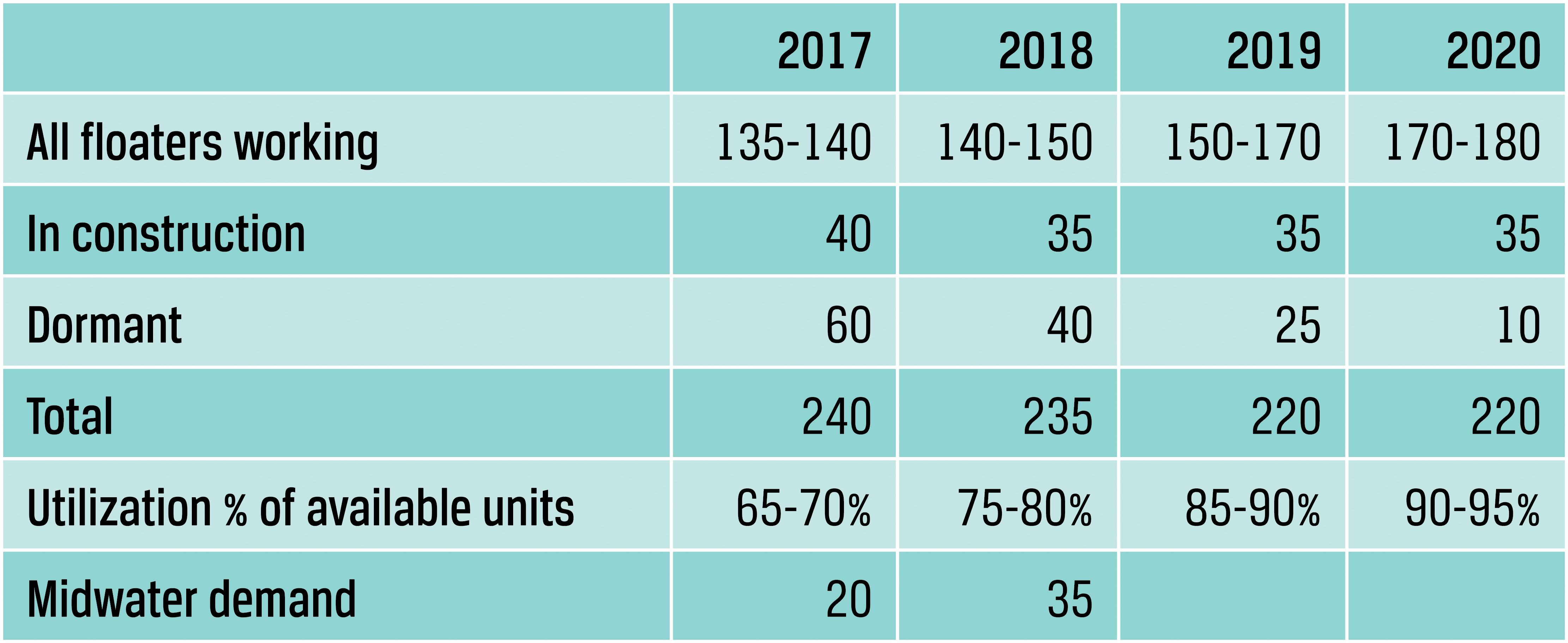

With shale oil production increasing with roughly one million barrel per year and two and a half to three million barrels replacement demand for conventional oil our Demand/Supply balance forecast for floating drilling units are as follows:

The marketed floater fleet has been reduced by 41% from its peak of 292 units in September 2014. It is expected that the overall fleet size continue to shrink further in 2018 as 58 floaters are 30 years or older, with 25 of them already off contract. Of the 27 new buildings currently under construction several have had their deliveries repeatedly deferred, with the possibility of yet further delays. Activity around stranded assets at ship yards is high with the recent purchase of four modern semisubmersible drilling rigs from their building yards at much reduced prices. Unfortunately we were not able to reach an agreement with Samsung Shipyard for our semisubmersible the Stena MidMax under construction and she is now bought by a Norwegian company Oddfjell Drilling. Nevertheless our claims for damages due to delays are quite substantial.

The UK market for floating drilling units still shows strong signs of activity with a lot of new projects having been sanctioned and coming online in 2019/20. Although there are fewer opportunities in Norway compared to the UK sector for 2019/20 demand is sustained by longer term projects requiring latest generation assets. In order to save bunkers for the operator i.e. the oil company, we are in the process of adding mooring to our pure DP unit the Stena Don. After drilling for Total this year we hope to continue after completion of the conversion next year also with Total.

Modern ultra-deep water units continue to be an attractive choice for operators. Most large players are taking steps to retire the units that have been cold stacked for over two years except for some cold stacked units which are considered modern. These units are being marketed at depressively competitive rates in the hope to be reactivated as a strategic move in order to have the unit warm and ready, when the market is going to be in a better shape a few years from now.

Overall, the floater market has seen a total of over 77 contracts cancelled by operators since the end of 2013. Since March 2018 there have been no contract cancellations.

On the contrary, provided we can maintain our new achieved cost base, we are very optimistic about employment for 2019 with better rates in 2020. An exception though is our oldest unit the Stena Clyde assigned to Australia and the Far East.

THE GLOBAL ECONOMY IS DOING FINE with a growth rate reaching 3% per year during 2018 and probably 2019. Inflation seems to remain at around 2% per year meaning interest rates will rise, but can stay low. The US economy showed strength during the latter part of 2017 and in the euro zone, greater political optimism and economic confidence are mutually reinforcing. Emerging market economies is expected to establish a continuous overall GDP growth of about 5% per year. In China a minor deceleration is likely as national leaders, after the Communist Party congress, take advantage of economic strength to tighten lending and prioritize debt reduction. Overall this is a good environment for companies to further increase their earnings.

Companies on the Stockholm stock exchange are currently valued at eighteen time earnings for 2018, which is on par with S&P 500 in the US, where a few highly successful technology companies such as Google, Facebook and Amazon weigh heavily. Given these valuation levels share-prices are vulnerable to disappointments. Swedish valuations in relation to book value P/BV is 2,44 well above the historic ten year average of 1,91. Return on equity is marginally below its historic ten year average. From a historical perspective, bond yields are still quite low but early 2018 yields on 10-year government bonds have climbed to their highest levels in four years in the US and are at two year high in Germany and Sweden. The US Fed has already started shrinking its balance sheet and both ECB (European Central Bank) and Riksbank-en will probably declare with increasing frequency how their ongoing quantitative easing programs for credits will be phased out and what the next steps will be. At present this should not be a problem for the stock market, but the strong support for equites provided by a relaxed monetary policy in the past will gradually fade.

The demand for condominium apartments in Sweden is fading, but the demand for new apartments to be hired will remain unsatisfied. Hence Stena Property (Stena Fastigheter) will continue an aggressive, but more cautious new building program.

In order to safeguard our ambitious program a substantial part of Stena Fastigheter assets have been sold to Stena Sessan Fastigheter a company also 100% controlled by the Sten A Olsson family. The stock of properties at Stena Fastigheter will be fully replenished in three years´ time. The sold properties will be continued to be administered by the organization at Stena Fastigheter.

As the Trump administration pushed through its tax reform most analysts expect US-based corporate earnings to enjoy an aggregate positive tax effect of 6-8% in 2018. Consensus estimate indicate an earnings upturn of 10% for US companies in addition to the tax effect.

With more unruly political situations in so many countries, with fast digitalization and with threats on existing free trade agreements financial markets will be volatile thus calling for less optimism. It could also well be that the peak for global growth already has been passed without anyone really noticing it.

We shall be happy to see that our asset heavy pieces of business are doing better. All our other pieces of business are at present doing fine.